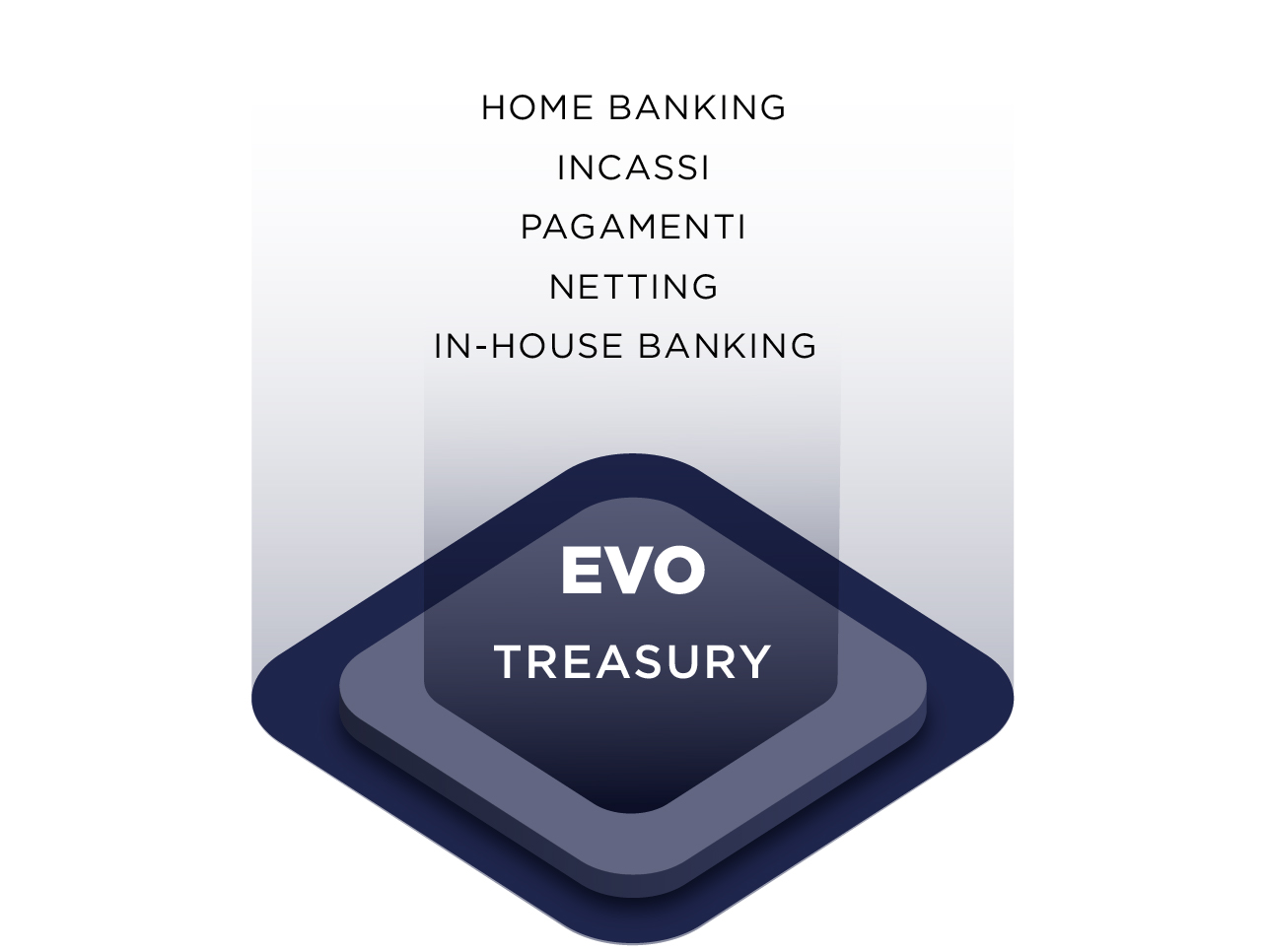

In today’s global economic landscape, the adoption of centralised treasury offers corporate groups a strategic opportunity to optimise their financial operations. The Piteco EVO features dedicated to in-house banking or centralised treasury are designed to provide complete visibility, strategic control and maximum efficiency over the liquidity of international entities, adapting to complexity and geographical spread.

Optimising liquidity with Cash Concentration

Cash Concentration is one of the key tools that a centralised treasury uses to optimise the Group’s liquidity management. Piteco supports Cash Concentration management by providing a real-time view of the Group’s cash flow. The functionality of consolidating the current account positions of each individual company allows for unified and strategic liquidity management in different currencies (account, country, holding company or additional consolidation currency).

Technical forms for every treasury need

Piteco supports the management of a wide range of technical forms used by national and international banking institutions, also managing complex scenarios with hierarchical and sub-holding centralisation models, ensuring complete and accurate multi-company accounting:

- Cash Pooling: centralised liquidity management.

- Zero Balance and Target Balance: automation of account transfers to the master account with zero balances or maintenance at a predefined level.

- Payments On Behalf Of (POBO): management of payments on behalf of subsidiaries.

- Receipts On Behalf Of (ROBO and COBO): management of receipts on behalf of subsidiaries.

- Regional Treasury Centre (RTC): centralisation and management of treasury activities for a specific geographical area of a group.

- Shared Service Centre (SCC): consolidation and provision of treasury services to Group entities by a centralised entity.

Global connectivity

Piteco integrates with various international banking formats and connects with leading info-providers and messaging services (Bloomberg, Reuters, SWIFT, SIA, PayPal). This means:

- Secure and reliable connectivity: for all financial transactions

- Rapid start-up of projects for banking, organisational and accounting centralisation: thanks to format standardisation.

Group Cash Forecast

The centralised Piteco platform generates Group Cash Flow Forecasts for the holding company, based on the forecast, estimated or actual movements of the subsidiaries with:

- Details on currency exposure: to mitigate risks

- Analysis of intercompany financial expenses and revenues: for accurate planning.

- Seamless ERP integration: Piteco interfaces simultaneously with different ERP systems, enabling centralisation models that are independent of the accounting systems involved and simplifying your IT infrastructure.

Payment Factory & Netting: centralised payments and clearing

Piteco’s Payment Factory & Netting features manage global payment and credit and debit clearing structures with the highest security standards:

- Multi-currency, multi-order and multi-company payments: with advanced segregation of duties (SoD) management

- Accounting and audit trail: for every transaction.

- Intercompany netting: easy management with dedicated dashboards and approval workflows to optimise internal cash flows.

Security and cutting-edge technology

Security is a priority. Piteco solutions integrate:

- Precise user profiling: for granular access controls.

- Segregation of duties (SoD): to prevent fraud and errors.

- Complete audit log: for the traceability of every operation.

- Advanced authentication methods: to protect data.