Piteco’s complete corporate Treasury management offering includes a highly specialised solution dedicated to Corporate Financial Risk Management. This modular suite offers advanced, integrated functions for strategy, business planning, control and determining financial risks by taking a comprehensive approach.

Corporate Financial Risk Management

The CFRM solution makes it possible to handle risks in different processes relating to corporate governance, risk control strategy planning, analysis and forecast assessment, accounting and regulatory compliance needs.

Types of risks managed

Direct integration with front-office portals for typical trade management activities; identification and measurement of all risks through middle-office activities using overall exposure consolidation (budget, orders, invoices, collections, payments, loans, security investments, etc.); management of hedging agreements relating to interest rate risk (IRS, Amortized IRS, FIRS, CCS, Floor, Cap); exchange rate risk (Forward, Spot, FX Swap, NDF, CCS, Forex Option, Barrier Option, Zero Cost Collar, flexible forward, FX Forward, Option Accumulator, Exotic Forex Option); commodity risk (Commodities Future Listed, Future Option, Exotic); and counterparty risk (scoring and default models). Financial and derivative agreement pricing function, simulation of existing transactions or of new instruments with the automatic generation of forecast flows.

Financial Modelling

The system also provides procedures to calculate Fair Value, CVA/DVA, sensitivity analyses based on deterministic scenarios or based on assumptions of changes in the current market scenario (Risk analysis, What if Analysis, Portfolio Analysis). It is also possible to perform the typical assessments required by IFRS and Local GAAP accounting methods (FV hedge, cash flow hedge, IAS39, IFRS7, IFRS9, IFRS13, Hedging card), in addition to typical administrative activities concerning reporting to external parties (EMIR, Trade Repository) and reclassifications.

Process management

The application automatically controls the quality of market data by connecting to the main data provider platforms or trading systems to automatically retrieve data. It incorporates a process workflow to define roles and relationships between roles or set automatic limits in keeping with corporate risk policies, also setting alerts if required.

Integrated analysis

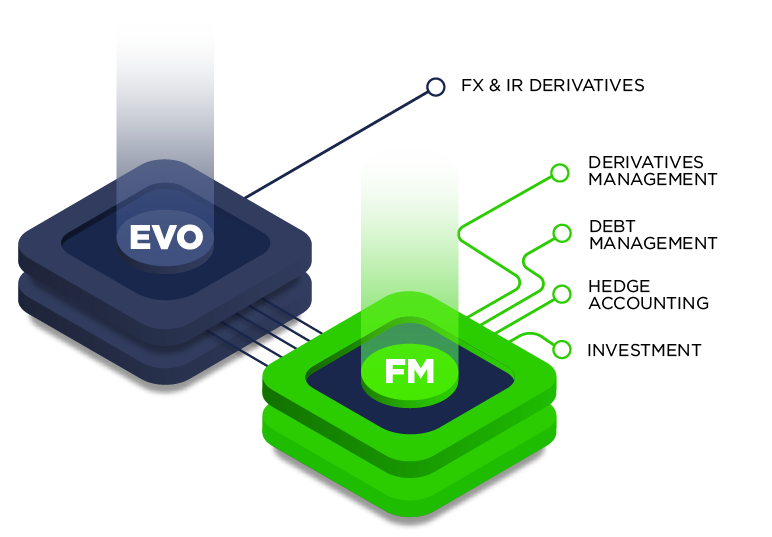

The native integration of the Piteco FM suite with the Treasury solution guarantees that the cash management situation will be continuously updated and enables overall financial assessments using cash-flow mapping, cash capital position or funding risk models that provide adequate tools to maximise company value and expected benefits.