In the Administration, Finance & Control area, Piteco has developed new reconciliation functions and routines for the management of non-uniform and unstructured data coming from various company Business Units, which require analysis, standardisation and validation activities to use such data in their business management systems.

Semantic data analysis

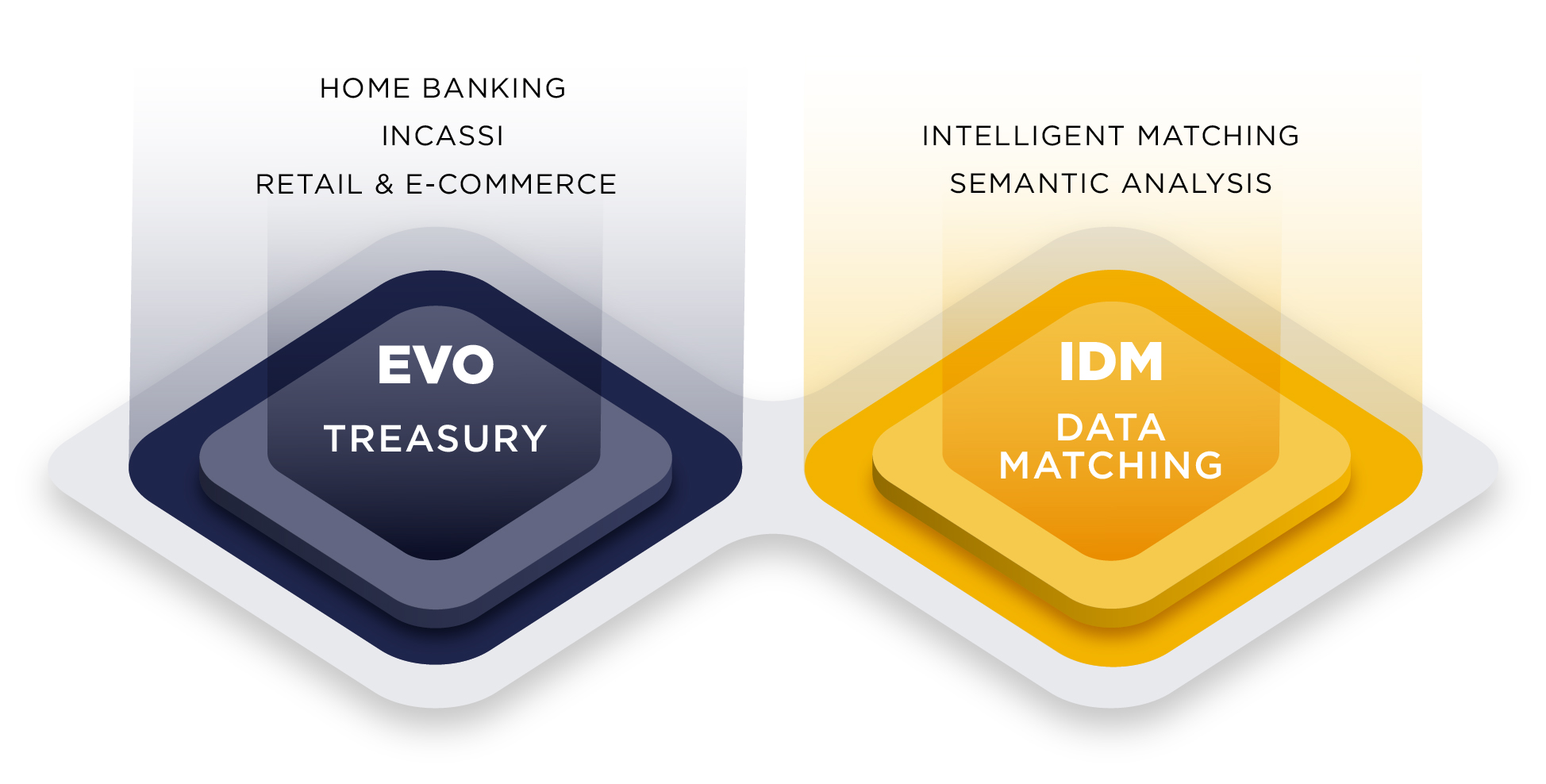

Using logics and functions that allow for the implementation of Regular Expressions, Piteco’s solutions initiate an innovative Semantic Data Analysis process as early as when the data are downloaded from the various source systems, which facilitates the subsequent application of Machine Learning algorithms and parametric matching logics for the dynamic processing of data flows coming from different sources.

The more than 40 years of experience with Treasury projects and the technological expertise of the Software Factory support Piteco’s constant commitment to researching and implementing new available technologies for data acquisition and processing, to significantly improve business efficiency indicators. This is achieved through Cognitive Computing and self-learning functions – to manage highly variable Treasury operations in complex scenarios – and the application of algorithms and procedures that make it possible to automate subsequent data processing phases.

Machine learning & smart reconciliation

Piteco leverages the new possibilities offered by technologies underlying new Machine Learning paradigms by applying them specifically to functions dedicated to the management of Cash Collection processes and automating the entire Collection Reconciliation process, even for unstructured payments, reducing uncertain cases, in which human intervention is required, to a minimum.

In this context, Piteco’s IDM platform supports companies that have significant invoicing and collection volumes, not only automating matching between payments received and receivables due, but also significantly eliminating the low value-added manual interventions, guaranteeing companies the automatic matching of up to 95% of transactions, by applying mathematical algorithms.

Sectors of application

The distinctive feature of Piteco’s Intelligent Data Matching functions is that they support non-uniform data matching processes in different business sectors and company areas, bearing witness to the in-depth customisation and parametric definition of the data structure.

Excellent results and replicable best practices have been achieved in Large Scale Retail, for the reconciliation of cumulative payment instructions and invoices, customer credit notes, allowances and discounts.

In the Consumer Credit, Loans and Salary-Backed Loans, optimising the reconciliation of collections from loan instalments.

In the e-Commerce world, reconciling front & back end data, online orders and credit card collections, managing carriers as well as cash on delivery.

In the Insurance sector, for matching between daybooks, broker account statements and policies.

And, lastly, in the Utilities realm, where Piteco IDM acts as an effective Single Collection Manager, intermediating and resolving the complex issues linked to multiple collection channels and billing systems.