In today’s economic climate, payment management is no longer just an operational necessity, but a strategic lever for every company. The Piteco suite for Digital Payments is an integrated ecosystem that optimises corporate payments, ensuring efficiency, control and security.

Automation, centralization and control

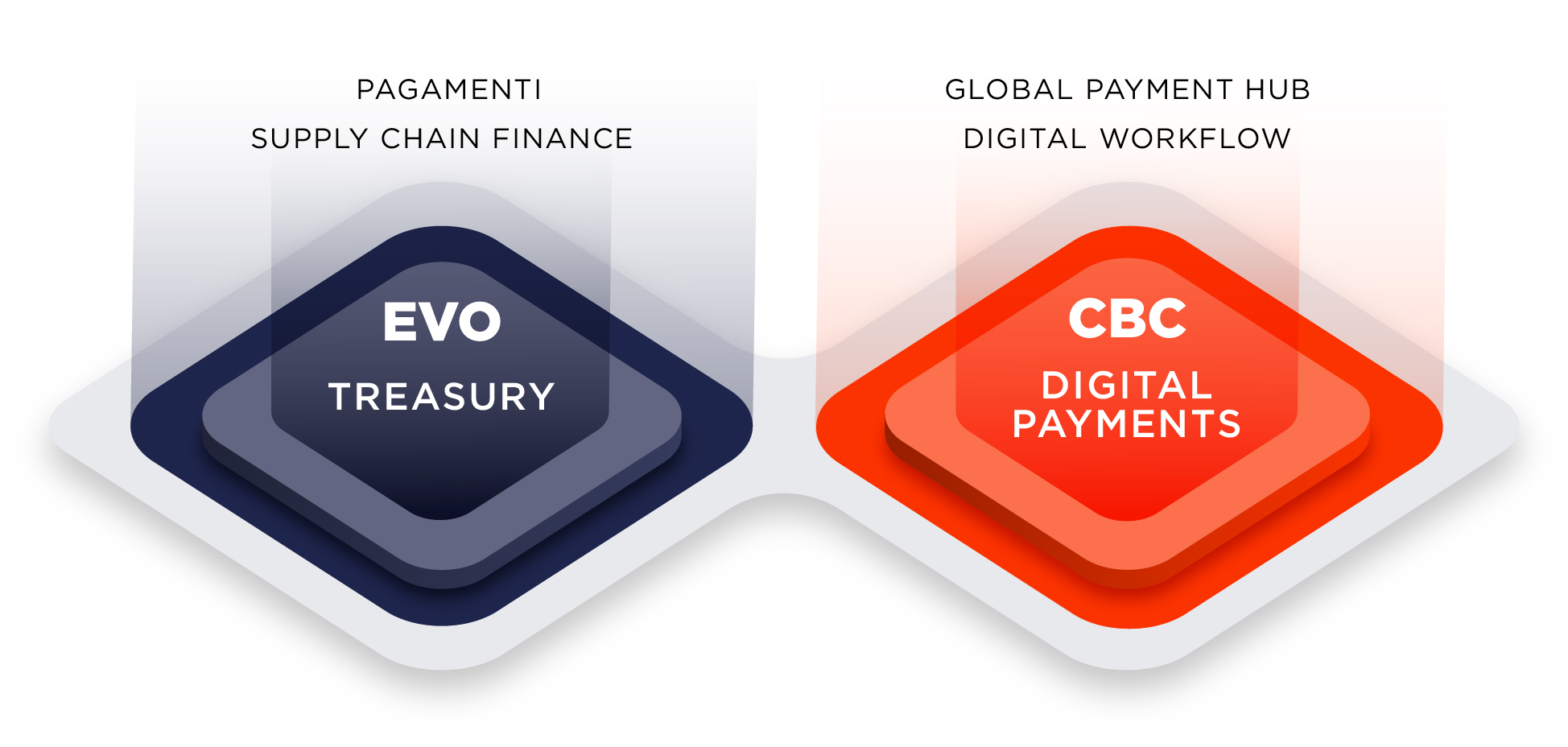

The Piteco platform allows you to consolidate and manage all types of payments – from domestic to international transfers, bulk payments to manual payments, salaries to urgent transactions – from a single, intuitive interface. It provides a complete, real-time view of corporate liquidity, granular control over every single transaction and the certainty that all banking formats are managed smoothly. Piteco also integrates innovative Supply Chain Finance solutions into the traditional banking channel.

Access to Swift

Piteco acts as a central hub for banking connectivity: thanks to the SWIFT Service Bureau offered by Piteco, it is possible to access the SWIFT network as a service, enabling connection to national and international banking networks.

The use of the Piteco cloud platform guarantees rapid activation and a plug-and-play approach, generating significant savings in terms of time and investment, with the highest security standards, managing crucial aspects such as user profiling, access control, Segregation of Duty (SoD), Audit Log and Privacy with the utmost care.

Robust security and compliance

IT security is at the heart of every CFO and treasurer’s concerns. The Piteco Digital Payments suite puts security first. Through the Corporate Banking Communication (CBC) platform, which is also accessible from mobile devices, every payment order is managed and automated through authorisation workflows, supported by digital signatures and the most rigorous cryptographic protocols. Not only is compliance with current regulations guaranteed, but proactive tools are also provided to prevent fraud and identify anomalies in real time, such as IBAN checks and controls on international transfers.

Fast & Instant Payments

The financial world is accelerating, and Piteco supports this acceleration. Piteco is fully aligned with the latest regulations, such as EU Regulation 2024/886, which makes instant payments the new normal, and has integrated Fast & Instant Payments into its Digital Payments solutions, allowing companies to reap the benefits of these types of payments.

- Instant Payments (SEPA Instant Credit Transfer): funds are credited in seconds, 24 hours a day, 7 days a week, 365 days a year. This mode is essential for urgent transactions, to improve cash management and to maintain strong relationships with suppliers who require immediate payments.

- Fast Payments: Piteco manages a full range of fast payment options, including SEPA Urgent transfers, Target2 payments and Same Day Value Cross Border payments.

Payment Factory Management

Piteco supports companies in the implementation and management of Payment Factory structures, both nationally and internationally. Thanks to its many years of experience with hundreds of projects for global groups, Piteco is able to optimise complex processes such as:

- Centralised structures and Share Service Centres (SSCs)

- Payment On Behalf Of (PoBo, CoBo) models

- Advanced strategies such as Cash Pooling and Zero Balance

Simplified international payments

Operating on a global scale with the Treasury tool: with Piteco, companies can make and receive payments in over 140 different currencies, without the need to open and manage numerous dedicated foreign currency bank accounts. This not only eliminates administrative complexities, but also translates into a significant reduction in transaction and conversion costs.

Thanks to our transparent rates and efficient management, every international payment becomes an opportunity to optimise liquidity and strengthen relationships with suppliers and customers worldwide.

Virtual Payments

Piteco is constantly committed to optimising digital payment methods and tools to ensure greater efficiency and a better customer experience. With this in mind, the innovative solution for paying suppliers via virtual credit cards represents a strategic advantage.

This method allows payments to suppliers to be credited on time, taking advantage of an additional spending limit and, at the same time, deferring the impact of the payment on the company’s cash flow. A solution that combines operational efficiency and financial flexibility.